In today’s fast-growing world of online commerce, the checkout experience plays a vital role in driving conversions. Complicated steps like logging in or switching between pages often cause customers to abandon their carts.

To tackle this issue, PayPal introduced ACDC (Advanced Credit and Debit Card Checkout) – a streamlined solution designed to make the payment process easier and faster. So, what exactly is PayPal ACDC, and how can it benefit eCommerce sellers? Let’s break it down.

What is PayPal ACDC?

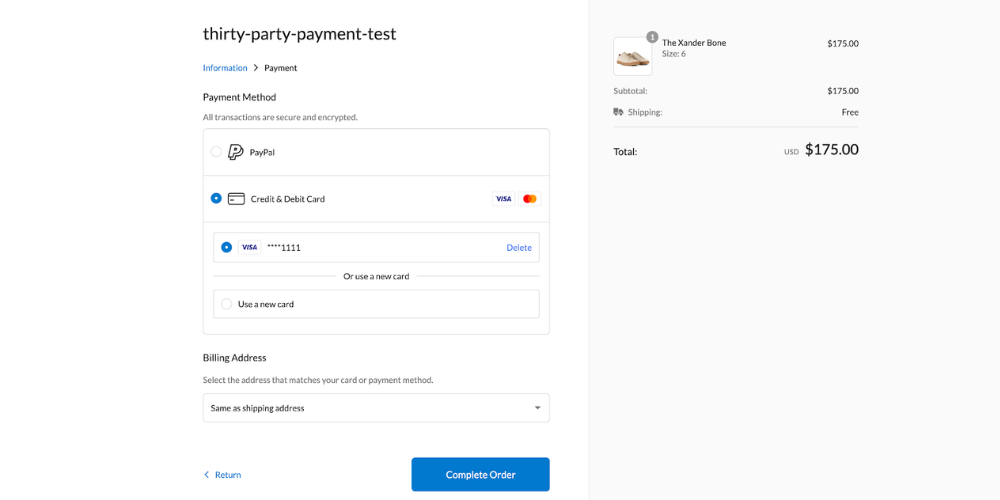

PayPal ACDC (Advanced Checkout with Debit and Credit Cards) allows customers to complete purchases using their credit or debit cards – without needing a PayPal account.

Unlike the traditional PayPal Standard Checkout, which redirects users to a PayPal-hosted page, ACDC allows customers to enter their card details directly on your store’s checkout page. The entire transaction is still securely processed by PayPal’s trusted payment system, ensuring top-tier protection for both buyers and sellers.

Key Features of PayPal ACDC

PayPal ACDC is built to optimize the online shopping experience while helping sellers reach global audiences and improve conversion rates. Here are its standout features:

Guest Checkout (No PayPal Account Required)

Customers can check out as guests – no PayPal login or account required. This is especially convenient for first-time buyers or shoppers who don’t use PayPal. It minimizes friction and helps customers complete their purchase in just a few simple steps.

Multiple Payment Options

In addition to credit/debit cards (Visa, Mastercard, American Express, Discover), ACDC supports digital wallets such as Venmo (US), Apple Pay, and Google Pay (depending on region). This flexibility helps sellers serve international markets more effectively.

Streamlined Checkout Interface

Customers can enter their payment information directly on the checkout page – no redirects, no extra steps. Everything is neatly organized – from card details and billing info to the confirmation step – creating a smooth and intuitive user experience.

Secure Transactions Powered by PayPal

All transactions are processed via PayPal’s secure payment gateway. Card data is encrypted and never stored on your website. Sellers also benefit from PayPal’s fraud protection, chargeback support, and dispute resolution services.

Benefits of Using PayPal ACDC

PayPal ACDC is quickly becoming a go-to choice for sellers looking to boost revenue and streamline checkout. Here’s why:

- Lower Cart Abandonment: ACDC allows customers to stay on your store’s checkout page without distractions or redirects, helping reduce drop-offs.

- Higher Conversion Rates: Sellers see up to 20–30% increase in conversions compared to traditional PayPal Standard Checkout, thanks to simplified flows and flexible payment options.

- Enhanced Security: ACDC handles all card data directly on PayPal’s system. You won’t need to store sensitive info or build your own PCI-compliant infrastructure – just meet the SAQ A-EP level of PCI DSS compliance.

- Better Customer Experience: A faster, more intuitive checkout process leaves a positive impression and increases customer satisfaction.

With these benefits, ACDC is particularly well-suited for fast-paced eCommerce businesses where every second counts.

ACDC vs. Standard Checkout: Side-by-Side Comparison

| Criteria | PayPal Standard Checkout | PayPal ACDC |

| Checkout Experience | Redirects to PayPal site for payment | On-site checkout – no redirects |

| Supported Payment Methods | PayPal balance, credit/debit cards | PayPal, credit/debit cards, Venmo, Pay Later, APMs |

| Checkout Speed | Slower (multiple steps and redirects) | Faster (fewer steps, no redirection) |

| Conversion Tracking | Limited tracking of incomplete checkouts | Tracks user journey for remarketing |

Important Considerations for Sellers

While ACDC brings powerful advantages, it also comes with several requirements sellers need to be aware of:

- Security Compliance: PayPal may request PCI DSS compliance reports. This standard protects cardholder data and is mandatory for sellers.

- Account Limitations: Business accounts have higher transaction limits, but PayPal can still place temporary holds if suspicious activity is detected.

- Data Sharing: PayPal may share transaction data with partners like American Express for analysis and product improvement.

- Potential Fees: In addition to standard processing fees, there may be extra service charges depending on your agreement with PayPal.

- Integration Requirements: ACDC integration requires technical setup. You’ll need developer support to ensure it runs correctly and reliably.

We understand these technical and operational hurdles can be challenging, especially for new sellers or teams without in-house developers. That’s why BettaMax has already integrated PayPal ACDC into our system — saving you time, reducing risk, and letting you focus on scaling your store.

Since 2024, BettaMax has been an official PayPal partner in Vietnam, with full source code vetting to meet the highest security and transparency standards.

As a certified partner, we also enjoy exclusive benefits from PayPal, which means better rates, more features, and stronger support for our sellers.

Start your cross-border selling journey today with BettaMax.

Conclusion

PayPal ACDC isn’t just another payment method — it’s a powerful tool that can significantly improve your conversion rate and customer experience.

To get the most out of it, sellers should be mindful of the technical and compliance requirements. Being prepared with the right knowledge on security, accounts, and integration will ensure a smoother onboarding and long-term success.

If you’re looking for a modern, flexible, and secure checkout solution, PayPal ACDC is definitely worth considering as part of your eCommerce growth strategy.