Managing fulfillment costs is one of the most critical decisions for ecommerce brands. A single order seems simple on the surface, but behind it lies a complex web of expenses from the moment inventory arrives at your warehouse to the second it reaches your customer’s door. Understanding how to calculate fulfillment cost per order directly impacts your bottom line.

In this comprehensive guide, we’ll walk you through every step of calculating fulfillment costs, provide three industry-standard formulas, and show you how major fulfillment providers charge their fees. You’ll also discover practical strategies to reduce costs and decide whether hiring a 3PL provider makes financial sense for your business.

What is a Fulfillment Fee?

Definitions of fulfillment fee

When businesses ask what is a fulfillment fee, they are referring to the per-order charge that a 3PL or fulfillment center applies to process an order from start to finish. A fulfillment fee usually covers core activities such as receiving products, inventory storage, picking items, packing them, and preparing the shipment for delivery. In other words, it represents the direct cost required to complete each outbound order, from the moment items enter the warehouse until the package is handed to the carrier.

Understanding what are fulfillment costs helps clarify that the fulfillment fee is only one part of the overall expense of running logistics operations.

Difference between fulfillment fee vs fulfillment cost

Fulfillment Fee

A fulfillment fee is a per-order charge, typically including pick-and-pack operations, order handling, basic packaging, and internal shipping preparation. You pay per individual order processed.

Fulfillment Cost

Fulfillment cost refers to the total operational expense required to run all fulfillment activities over a given period. This includes storage fees, inbound receiving, labor, software systems, shipping labels, return processing, and other overhead. This mean fulfillment cost broader than a fulfillment fee, used for accounting, cost control, and operational management.

8 key components of fulfillment costs explained

To understand how to calculate fulfillment costs per order, focus on the core cost elements that influence your final CPO:

- Receiving & inbound processing: Includes unloading, quantity checks, inspections, and SKU labeling. Typical cost: $0.50–$2.00 per unit.

If you often see orders stuck in early stages, learning what awaiting fulfillment means can help you diagnose bottlenecks before they increase your costs.

- Inventory storage: Charged per bin, pallet, or cubic foot. Small sellers usually pay $1–$3 per cubic foot annually, depending on turnover rate.

- Picking & packing labor: Warehouse teams retrieve items, scan SKUs, prepare packaging, and seal orders. Average cost: $0.75–$1.50 per order, higher for complex orders.

- Packaging materials: Boxes, poly mailers, tape, inserts, and branded packaging. Costs range $0.50–$1.50, with premium packaging exceeding $3+.

- Shipping label & last-mile delivery: The largest cost variable. Standard shipping runs $3–$8; expedited shipping is often $15+. 3PLs secure 15–25% discounted carrier rates.

- Labor & warehouse overhead: Covers replenishment, QC, put-away, audits, and general warehouse operations. Usually blended into cost-per-order.

- Software & account management fees: WMS/OMS platforms, integrations, dashboards, and support teams. Monthly fees range from $100 to $1,000+ depending on volume and complexity.

- Returns processing fees: Receiving returns, inspection, restocking, and updating inventory. Standard cost: $2–$5 per return, higher for apparel or fragile goods.

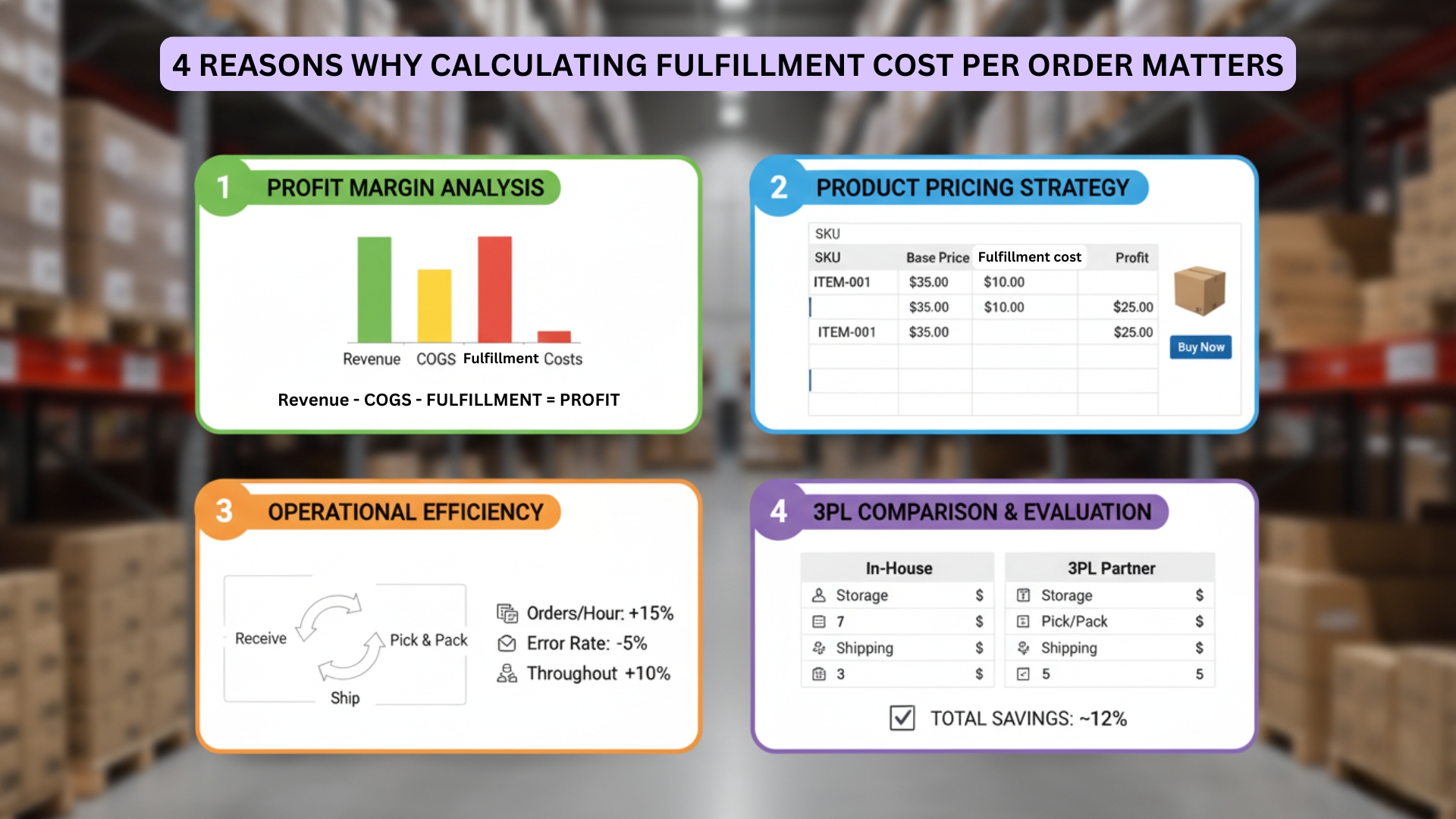

4 reasons why calculating fulfillment cost per order matters

Impact on profitability and margins

Calculating fulfillment costs isn’t just about accounting, it’s about survival. If you sell a $50 product with $15 in COGS and $8 in fulfillment costs, your gross margin shrinks to $27, or 54%. Without knowing this, you might underprice and erode profitability. Seasonal spikes in storage fees can silently destroy Q4 margins.

Set accurate product pricing

Knowing your exact fulfillment cost per order allows you to set prices that actually cover expenses. A lightweight, compact item might support a $20 retail price, while a bulky, heavy item requires a $40+ price to maintain margins. This knowledge directly informs your inventory selection strategy.

To better understand how orders move through your warehouse workflow, you can review what fulfillment status means and how each status affects cost and speed.

Reveal cost inefficiencies

Tracking costs also reveals inefficiencies that drain your margins. If picking labor suddenly doubles, you can investigate root causes. If return rates spike, you might invest in better product descriptions or packaging to prevent damage.

Compare 3PL providers accurately

Different 3PLs charge different rates. Only by understanding and calculating fulfillment cost per order can you compare providers accurately and choose the best fit for your business.

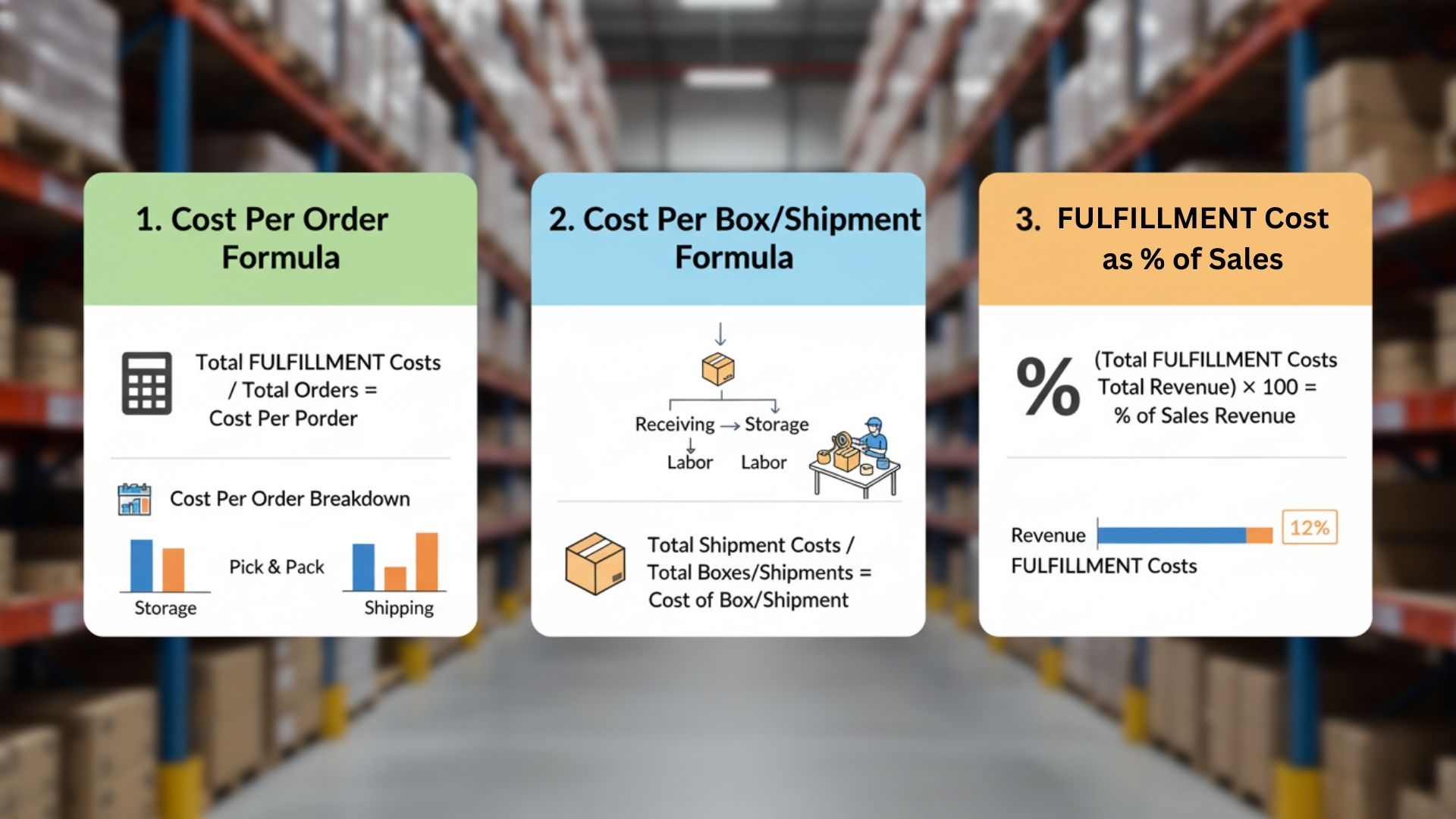

3 proven formulas to calculate fulfillment costs per order

Ready to calculate? Use these three formulas depending on your business model. Learning how to calculate fulfillment cost per order is essential for any ecommerce operator seeking profitability.

Formula 1: Cost Per Order (CPO) Total Monthly Fulfillment Costs / Total Orders Shipped That Month = Cost Per Order

Example: $12,000 monthly fulfillment expenses ÷ 3,000 orders = $4.00 CPO

This is the most straightforward method, ideal for businesses with relatively uniform order sizes and shipping profiles.

Formula 2: Cost Per Box (CPB) [Picking & Packing Labor + Packaging Materials + Handling] / Total Boxes Shipped = Cost Per Box

Example: $6,000 ÷ 3,000 = $2.00 CPB. Add shipping ($4.50 average) = $6.50 total per order

CPB works best if your orders vary significantly in size. Multi-item orders cost more to pack, so CPB captures this variance better than CPO.

Formula 3: Fulfillment Cost as Percentage of Sales (Total Monthly Fulfillment Costs / Total Monthly Revenue) × 100 = Percentage of Sales

Example: $12,000 ÷ $60,000 × 100 = 20%

Benchmark ratios: Under 15% (highly efficient), 15-25% (healthy range), 25-40% (higher costs), 40%+ (red flag). When you calculate fulfillment cost per order as a percentage of sales, you get a realistic view of whether your margins can sustain growth.

5 fulfillment cost calculators by major providers

Different fulfillment providers use different pricing models. Here’s how to calculate costs for the biggest players and determine how to calculate fulfillment cost per order with each platform.

Amazon FBA: Per-unit fulfillment fee varies by size/weight, storage fees at $0.87 per cubic foot/month, long-term storage at 15% of sale price, plus removal fees. Example: $50 product costs approximately $2.41 fulfillment + $0.15 storage + $7.50 commission = $9.05+ monthly per unit.

Shopify Fulfillment Network: $2.75 to $5.50 per order, $0.25 per cubic foot storage, $0.75 per return. Best for Shopify Plus merchants seeking native integration.

ShipBob: $0.99 to $1.50 per order (negotiable), $8 to $12 per cubic foot annually, $2 to $4 per box depending on weight. ShipBob makes it simple to calculate fulfillment cost per order since their model removes surprise storage charges.

Deliverr/Flexport: $0.50 to $1.25 per order, $2 to $6 per cubic foot annually, $99 to $299 monthly platform fee, plus discounted shipping rates (20-30% off).

How to reduce fulfillment costs

Once you know your costs, optimize strategically. Reduce box size by 10% to save on materials and carrier fees. Implement inventory forecasting tools to reduce storage waste by 20-30%. Once you hit 500+ monthly orders, negotiate carrier rates for 15-20% discounts.

Batch pick similar orders to reduce picking time by 30-40%. Distribute inventory across multiple fulfillment centers closer to customers to cut shipping costs. Consolidate slow-moving SKUs to reduce picking times and storage costs.

When to use a 3PL provider to lower fulfillment costs

A 3PL becomes a smart choice when your order volume grows beyond internal capacity. Businesses shipping more than 500 orders per month usually save money because 3PLs negotiate stronger carrier rates. It is also beneficial when you manage multiple sales channels and need centralized, real-time inventory control to prevent overselling.

If you’re considering outsourcing fulfillment to reduce operational expenses, you may also want to explore what is 3PL and how it works to determine whether a third-party logistics partner fits your growth stage.

If returns exceed 10 percent of revenue, a 3PL can handle inspections, restocking and documentation more efficiently. Outsourcing also helps when labor costs rise, warehouse space becomes limited or delivery speed starts to slow down. In these situations, partnering with a 3PL reduces operating costs and strengthens overall fulfillment performance.

FAQs about calculating fulfillment cost per order

What’s a reasonable fulfillment cost per order?

For most ecommerce brands, 15-25% of order value is healthy. A $50 order should cost $7.50 to $12.50 to fulfill.

How do I reduce fulfillment costs without outsourcing?

Focus on inventory optimization, packaging efficiency, and negotiating better shipping rates. Even 5-10% improvements compound quickly.

Is Amazon FBA cheaper than 3PLs?

For small sellers (under 1,000 orders monthly), yes. For larger sellers, 3PLs often win due to volume discounts and no long-term storage penalties.

Why is it important to calculate fulfillment cost per order regularly?

Regular calculations reveal cost trends, identify inefficiencies, and help you make timely decisions about pricing, outsourcing, or process improvements.

Conclusion

Calculating fulfillment cost per order isn’t optional, it’s essential for profitability. Start with Formula 1 (CPO), benchmark against industry standards, and audit your costs quarterly. Whether you choose Amazon FBA, ShipBob, Deliverr, or a regional 3PL depends on your volume and growth stage.

Remember: a 5-10% reduction in fulfillment costs flows directly to your bottom line. When you calculate fulfillment cost per order systematically, you transform a hidden liability into a competitive advantage. Start by calculating your current CPO using Formula 1, then audit each cost component to identify quick wins.